The Key — Penn’s Endowment Can’t Overcompensate for Overspending

Penn’s first quarter financial results look strong on paper but mask deeper structural constraints.

At last week’s Penn Board of Trustees meetings, the university reported that total assets ended 0.9% above expectations for Q1 of FY2026, which ended on September 30th. Revenue exceeded budget goals, as did costs, but the revenue surplus was larger and led to an increase in net assets.

At face value, this sounds like good news. But much of the “extra” revenue in Q1 came from restricted donor gifts that can only be used for specific purposes and cannot be redirected to meet broader budget needs.

This short-term pattern of covering above-budget expenses with temporarily elevated but restricted income is not a viable long-term strategy.

With 90% of endowment accounts donor-restricted, an increased 1.4% to 4% tax on investment income looming, and Penn’s hybrid spending rule limiting annual endowment depletion, the university cannot rely on the endowment to supplement long-term operations.

While some have called for universities to fill funding gaps by spending down their endowments, Penn’s financial structure makes this impractical. The short-term surplus masks a broader challenge: ongoing revenue constraints that require more sustainable solutions.

Unexpected gains, unexpected costs

The university reported both revenue and expenses above expectations for Q1 FY2026. As of September 30, Penn reported $34.4 billion in net assets, almost $500 million more than the end of the last quarter and $110 million above budget.

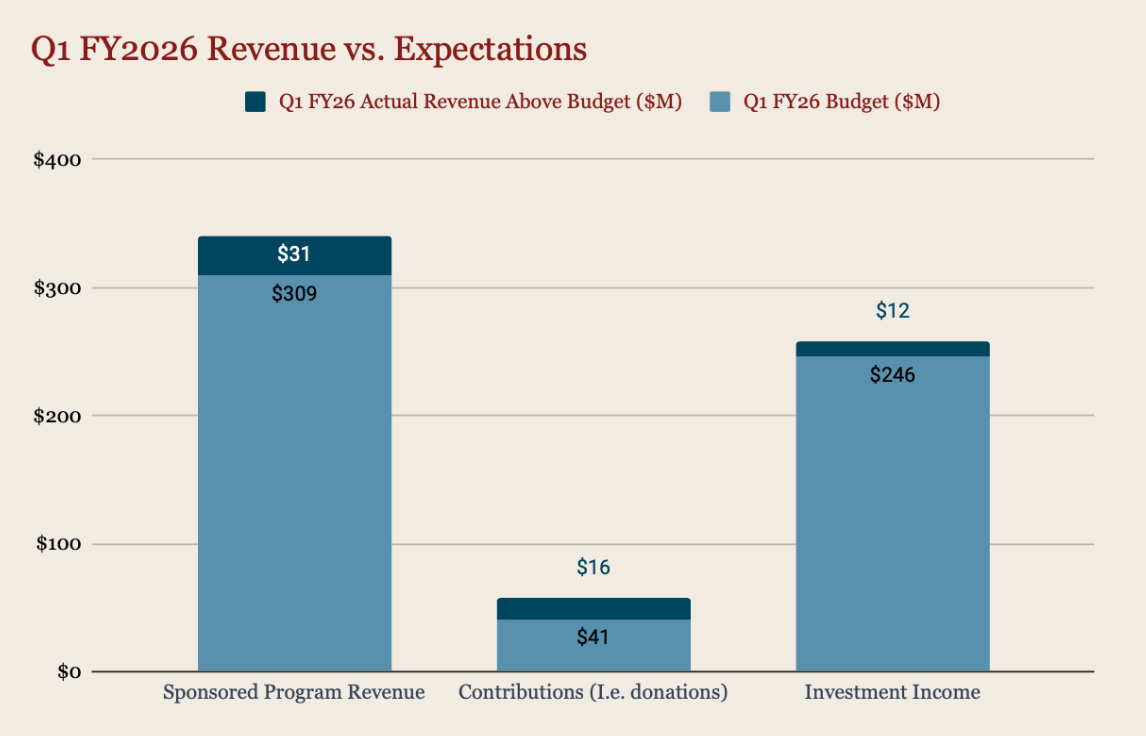

The increase came from key areas beating budget expectations, including:

$31M in sponsored program revenue

$16M in contributions

$12M in investment income

Source: November 6th Penn Board of Trustees Meeting

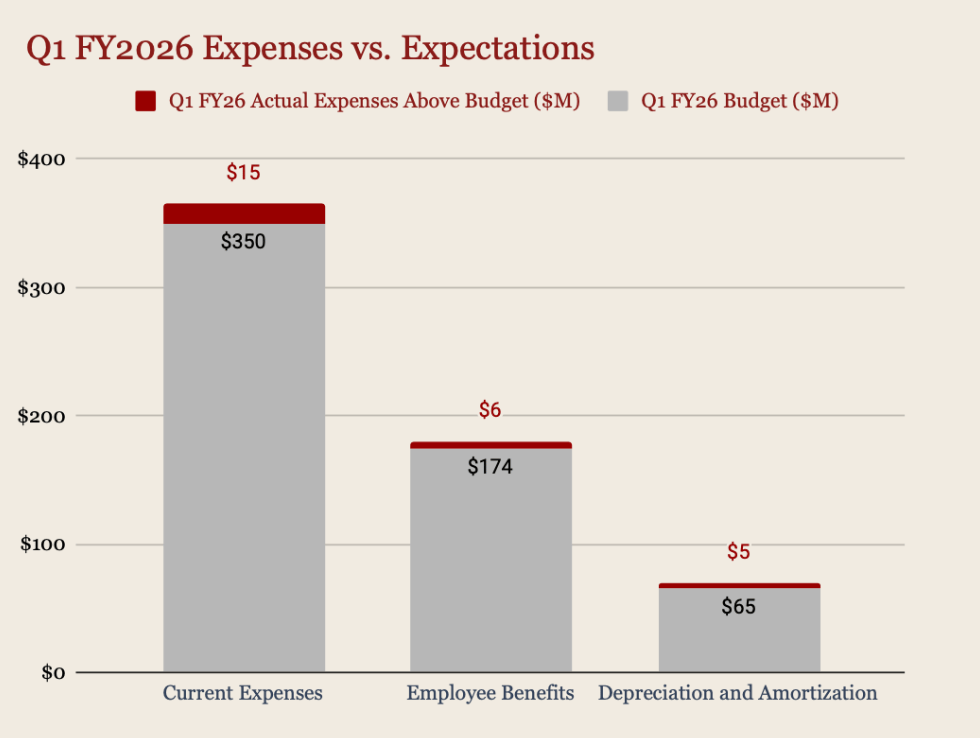

But expenses overshot expectations as well, with capital expenditures landing $21M above budget. Higher than expected expenses were driven by:

$15M from current expenses (the everyday costs of university operations)

$6M from employee benefits

$5M from depreciation and amortization

Source: November 6th Penn Board of Trustees Meeting

Net assets ended Q1 0.9% above expectations, so the unexpected gains outweighed the unexpected losses on the whole this time. But a key detail changes the interpretation: gift commitments and receipts jumped 158% and 89% above Q1 FY2025 respectively.

Because 90% of endowment accounts (many of which are from gifts) are donor-restricted, this windfall does not translate directly into flexible funding for Penn.

The first quarter was good, but the trajectory of overspending is not.

The myth of tapping the endowment

Penn’s $24.8 billion endowment is not an all-access emergency fund. Instead, it comprises 8,000 individual accounts divided into two categories: donor-restricted funds – used only for dedicated purposes decided by the donors – and the other 10% of accounts used to fund specific operations across the university and health system.

The 90% of accounts that are restricted constitute about half of the endowment’s dollars, $11.5 billion as of June 2025. Even within the less restricted funds, expenditures are committed to various programs and causes.

Penn also follows a hybrid spending rule to ensure the endowment can sustain long-term operations.

Each year, the spendable income from the endowment is based primarily on the previous year’s investment income. The amount spent is calculated by multiplying the previous year’s income by 70% (and an inflation factor). That piece is then added to the market sensitivity amount, which is equal to 30% of the market value of the endowment at the end of the last FY multiplied by Penn’s 5% annual spending rate.

This structure allows for enduring fund support for target programs, scholarships, and other commitments, based on conservative estimates of endowment returns and inflation. The 5% target exists to protect long-term operations. Spending more than that today would mean less support for instruction and faculty, research, financial aid, health care tomorrow. The endowment would also weaken structurally just as federal funding may tighten.

Pressure on the endowment is rising. During the trustees meeting, Penn’s leadership team also emphasized the expected impact of the Big Beautiful Bill Act’s changes to the endowment tax in FY2027. Penn expects an almost 200% increase in its tax burden on net investment income, with the tax rate expected to increase from 1.4% to 4%.

Financial strength requires more than good returns

When President Larry Jameson declined to sign the federal government’s draft Compact for Academic Excellence, overspending became an even riskier bet. The White House warned that universities declining to sign “elect to forego federal benefits.”

For Penn, which receives over $1 billion in annual federal funding, the impact may be drastic. If this funding disappears, no realistic endowment spending can backfill the loss. Penn’s $16.5 billion (and growing) in annual expenses would quickly overwhelm even aggressive endowment spending.

Penn is still expecting good results for FY2026 based on a strong market, high donations, and a positive sponsored research variance in its first quarter. But overspending can be a slippery slope, and the first quarter’s unexpected gains are not stable, flexible, or repeatable sources of cash.

Penn must confront the real problem: if expenses continue to outpace expectations, costs will become more than the university can sustainably support. Penn’s leadership made clear last week that the endowment is meant to secure the university’s future, not subsidize overspending in the present.

Donor gifts cannot substitute a structural shift, and the endowment cannot shield Penn from the consequences of rising costs or new tax burdens. The endowment is a support, not a solution. Penn’s long-term strength will depend not on lucky quarters but on disciplined choices.

The Almanac

Jamie Dinan confirmed as next chair of the Wharton Board of Advisors

Following current chair Marc Rowan’s (W '84, WG ‘85) completion of his nine-year tenure in role on June 30th, Dinan (W '81) will assume his first three-year term. Dinan has served on the Wharton Board of Advisors since 2013 and is also on the university Board of Trustees.

Dinan is the founder, chairman, and CEO of York Capital Management. Recently, Dinan’s presence on campus has grown with a donation to restore a Wharton academic building, which was renamed Dinan Hall this spring.

So what? During his tenure, Rowan was an outspoken advocate for reform at Penn, championing a public campaign to remove former President Liz Magill from her role and helping to draft the initial Compact for Academic Excellence in Higher Education. Dinan has been quieter about his opinions on higher education and Penn’s direction, suggesting that Wharton may be entering a less activist era of board leadership.

President Trump defends international student enrollment at American universities

Since Trump took office in January, a national security push has focused on limiting international student enrollment at US universities, including by revoking some student visas and blocking issuance of visas for certain countries. Secretary of State Marco Rubio even threatened to revoke Chinese student visas and prevent new applications from being processed.

So what? The president’s insistence on the financial importance of international students is critical for Penn, where they compromise 13% of the undergraduate Class of 2027 and 27% of the overall student body. Federal support for continued international enrollment is integral to Penn’s financial stability.

Department of Education publicizes new higher education grant priorities highlighting AI and civil discourse

The Department of Education announced new post-secondary education grant pools for artificial intelligence (AI, $50M), civil discourse ($60M), accreditation ($7M), and short-term programs to train Americans for the workforce ($50M). Institutions must submit proposals by December 3rd, with awards expected by the end of the calendar year.

The new grants sit under the Fund for the Improvement of Postsecondary Education (FIPSE), created in 1972 to “improve postsecondary educational opportunities.” These new grant areas reflect the federal government’s priorities and what Under Secretary Nicholas Kent called a “transformative shift in higher education.”

So what? As the Trump administration shifts its funding priorities, Penn has an opportunity to be rewarded for its current innovation priorities and steer towards more potential areas of increased funding. Penn could expand its AI offerings, building on its first-of-the-Ivies BSE in AI and new undergraduate concentration and MBA major in AI in Wharton. The university could also pursue grant support to expand, and create new, civil discourse initiatives.

Thank you for reading the Franklin’s Forum newsletter! We love connecting with our readers — send us your thoughts and questions, Penn news, and ideas for future issues. If you enjoyed this edition, please spread the word by forwarding it to friends and classmates.